The team works with Intuit’s Tax and Bookkeeping experts, recruiters, and thought leaders. It provides valuable resources, insights, and opportunities to help people achieve their career goals and business ambitions. When you and your team are too busy to work on your books, you can fall behind. This can result in your financials becoming outdated, inaccurate, and unable to offer insights into your business.

Previous PostWant to Avoid Stressful, Sleepless Nights at Tax Time? Do This.

However, more knowledge is always an asset, and a bookkeeping certificate can make your resume look more attractive, potentially helping you to gain clients. If you’re looking for a cloud-based bookkeeping software that doesn’t require hours of training, try FreshBooks. It’s simple to work with, yet it doesn’t compromise on essential functions and features. As an independent business owner, you’ll have to learn how to do your freelancing taxes too.

Is bookkeeping a stressful job?

The final two parts of the exam are free and included in the workbooks. The first is the American Institute of Professional Bookkeepers (AIPB), and the second is the National Association of Certified Public Bookkeepers (NACPB). Both offer similar benefits regarding membership, resources and renewable credentials.

Let us know what type of degree you’re looking into, and we’ll find a list of the best programs to get you there. Featured or trusted partner programs and all school search, finder, or match results are for schools that compensate us. what is a periodic inventory system + when to use it This compensation does not influence our school rankings, resource guides, or other editorially-independent information published on this site. Christine is a non-practicing attorney, freelance writer, and author.

Can I do my own bookkeeping for my business?

- This method offers a true snapshot of your assets and debts at any given time.

- Many of the processes, policies, and procedures include detail-oriented tasks to ensure financial accuracy.

- The best time to hire a bookkeeping partner is before you really need one.

- As a result, many accounting professionals start their careers in a bookkeeping role to build the experience they need for more senior positions.

- Since nearly anyone can call themselves a bookkeeper, you’ll want to ask about their background.

There are high stakes when managing a business’s financial statements, which can lead to stress. However, if you have a rigorous organizational system and a solid knowledge of rules and regulations, it can be straightforward and easily manageable. Suppose you’re looking for support with your everyday bookkeeping needs. In that case, whether you’re a freelance bookkeeper with several clients or callable bond definition simply looking to handle the bookkeeping for your own business, FreshBooks can help. Our cloud-based bookkeeping software solution is quick, efficient, and capable of saving you countless hours of administrative work. Taking software-specific certifications can also enhance your credibility.

Bookkeeping offers a good starting place in the accounting field, with minimal education and experience requirements. You can develop valuable skills such as tracking transactions in bookkeeping software and creating reports, such as balance sheets and income statements. Being attentive to your business as it’s growing is crucial when it comes to reaching your goals. Luckily, bookkeepers and bookkeeping software are here to take the stress out of daily administrative tasks and sort out that mountain of paperwork. Focus on your business and hire a virtual bookkeeper with QuickBooks Live Bookkeeping. Take advantage of books that are 100% accurate from bookkeepers with over 10 years of experience for confidence and peace of mind.

The job also requires an eye for detail, organization, and some basic math skills. Bookkeepers typically don’t need experience, as they often learn the required skills as they go. As a result, many accounting professionals start their careers in a bookkeeping role to build the experience they need for more senior positions. A master’s degree in accounting, for example, may help you pursue leadership positions in your field or organization.

Required Education for a Bookkeeper

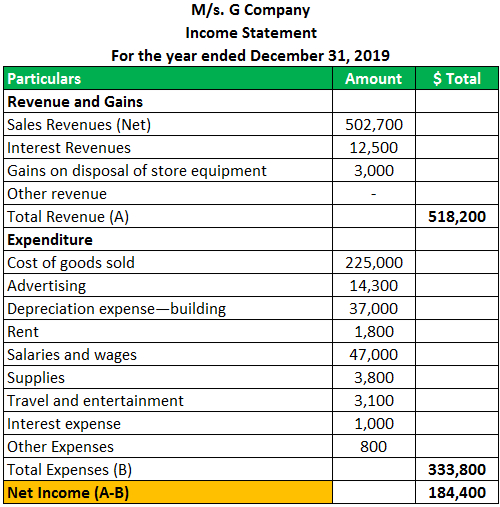

Since the information gathered in bookkeeping is used by accountants and business owners, it is the basis of all the financial statements generated. Most accounting software allows you to automatically run common financial statements such as an income and expense statement, balance sheet and cash flow statement. Business owners or accountants can then use these statements to gain insight into the business’s financial health.

Because the funds are accounted for in the bookkeeping, you use the data to determine growth. Broadly, a bookkeeper’s job is to manage the books by keeping track of day-to-day business finances. Bookkeeping professionals have their own expertise based on the types of payroll and hr app and online marketplace businesses and industries they serve.

You will likely want to establish a business banking account and credit card. This can help you keep your own business expenses organized and separate. If you plan to hire employees, such as an administrative assistant, you may also want to seek a small business loan. If you seek funding from a bank or investor, your business plan will be especially important because it is how potential lenders and investors will understand your business. You want your business name to reflect you as a person and the type of services you provide. Your business name is the first thing that lets customers, clients, competitors and others in the marketplace know about who you are and what you do.